Learn about the upside of cobalt prices

cobaltThe lithium concept board has been rising recently, and perhaps most people think this is a normal rebound. Let's take a look at the logic of the rise in cobalt prices.

1. Global Reserves

According to data from Flush Financial, the global cobalt reserves in 2018 were about 6.4 million tons. The distribution of countries is as follows:

About 3.4 million tons came from the Democratic Republic of Congo, or 49 percent of the global total. It was followed by Australia with 1.2 million tons, or about 18 percent of the world. Cuba ranked 4th with about 7 percent of the world's population; the Philippines Zambia ranks 5th with about 4 percent of the world's population; Zambia ranks 6th with 4 percent; Russia 4 percent; Canada 3; China and the United States 9 and 10, respectively, with 1 percent of the vote.

2. Global production

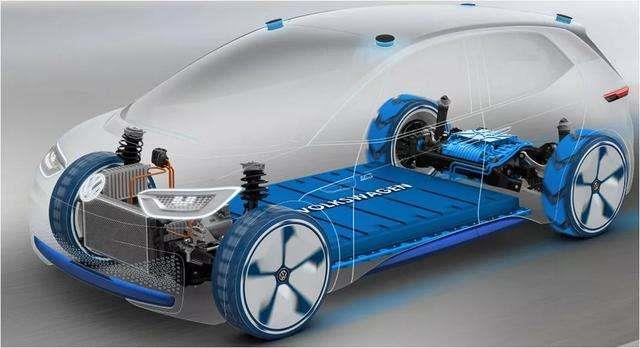

According to Flush Financial, global cobalt production in 2018 was about 140,000 tons, accounting for 2.1 percent of total reserves. At this rate, it could be mined within 50 years. It may actually be faster because with the development of new energy vehicles As the market expands and the demand for cobalt, such as new energy batteries, becomes larger and larger, it should be faster in the future. Global cobalt production in 2018 was only 30,000 tons higher than in 2017, a year-on-year increase of 27 percent.

Due to the incomplete statistics of 2018, I used the data of 2017 to make a forecast. In 2018, the cobalt mine production in the Democratic Republic of Congo was about 97,400 tons, accounting for about 70% of the total global production.